Compliance for Collection and Receivables Management Organizations

Increased demand for security, privacy and regulatory compliance has escalated the need for collection and receivables management organizations to become SOC 1® compliant. The SOC 1® is playing an important role for service organizations by establishing credibility and trust with their customers and has been used as a marketing tool to enter new markets or expand existing market share.

Information security is not the only relevant component of SOC 1® attestation. Collection and receivables management organizations are responsible for recording and processing transactions that have a financial impact to their customers. Their SOC 1® attestation should have an appropriate balance of information technology and quality control procedures over the transaction processing to ensure that customer’s records are secure and account balances are accurate and reliable.

Collection and Receivables Management Organization’s SOC 1® attestation involves the following critical areas:

- Control Environment: the organizational level controls also known as “tone at the top” which consists of management’s oversight and internal operational level controls.

- Physical Security: the protection of information systems as it relates to third party data.

- Environmental Security: the protection of information systems and data from environmental threats.

- Data backups: the availability and protection of third parties’ data.

- System Availability: the availability of information systems to user organizations.

- Application Change Control: the processing and procedures used to ensure that systems function per user requirements.

- Information Security: the logical protection of data from unauthorized system access.

- Client Account Setup: new clients are setup according to contracted terms.

- Receivables Data Input: new receivables data is completely and accurately recorded for collections processing.

- Collection Services Support: collection notices are completely and accurately processed, mailed and followed up on.

- Collection Receipts: received collections are completely and accurately applied to the proper account and appropriate funds submitted to user organizations.

Collection and receivables management organizations can use Section 5 “Other Information Provided by the Service Organization” of the SOC 1® report to communicate their efforts to comply with various state laws and regulations as well as many regulatory requirements such as: Truth in Lending Act, Fair Credit Reporting Act, Fair Credit Billing Act, Equal Credit Opportunity Act and Fair Debt Collection Practice Act.

The scope of the SOC 1® attestation is determined by the collection and receivables management organization. Accordingly, a well scoped attestation can clearly demonstrate your organization’s quality of service and ensure that sufficient information is provided to your user organizations to communicate your stringent controls over physical security, environmental security, authorized access and continuous availability of services.

SOC 1® Compliance Process

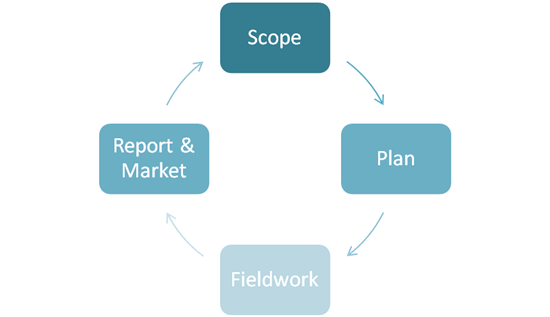

We tailor every attestation engagement to our client’s requirements. However, we have a fundamental four phase process that normally meets our clients’ needs and creates an efficient, unobtrusive attestation engagement that enables you to focus on your business while we focus on your compliance.

Project Timeline: Four Phase Attestation

For More Information Speak to a Service Auditor at Roosa CPA, LLC (877) 410-8516