Compliance for Banks and Financial Services Organizations

In today’s global financial market, banks and financial services organizations are experiencing broader competition while simultaneously facing a significant increase in regulatory requirements; these two factors are shrinking margins and squeezing profitability. To cope with these changes and remain competitive, banks and financial services organizations are outsourcing business processes that were, for many years, performed in-house. Bank processes that are outsourced range from recording or processing financial information by a service organization to a software development company building and hosting the software that is used by the bank. If your customers are banks or financial services organizations, your organization will be placed under the same increased banking regulatory requirements; these regulatory requirements might be satisfied by the stringent SOC 1® requirements. SOC 1® is playing an important role for service organizations by establishing credibility and trust with banks and financial services organizations.

Simply put by an attest client, “A SOC 1® examination tells our customers that we are doing what we promise.” Although this may not be the most technical answer, it is generally aligned with the purpose of a service auditor’s report.

The SOC 1® attestation for service organizations in the Banking and Financial Services industry should involve the following critical areas:

- Control Environment: the organizational level controls also known as “tone at the top” which consists of management’s oversight and internal operational level controls.

- Physical Security: the protection of information systems as it relates to third party data.

- Environmental Security: the protection of information systems and data from environmental threats.

- Data backups: the availability and protection of third parties’ data.

- System Availability: the availability of information systems to user organizations.

- Application Change Control: the processing and procedures used to ensure that systems function per user requirements.

- Information Security: the logical protection of data from unauthorized system access.

- Data Communication: the data maintains its integrity and security as it is transmitted between third parties and the service organization.

Service organizations can use Section 5 “Other Information Provided by the Service Organization” of the SOC 1® report to communicate their efforts to comply with various state laws and regulations as well as many regulatory requirements such as: Federal Trade Commission Standards for Safeguarding Customer Information, Gramm Leach Bliley Act, Sarbanes-Oxley Act, Securities and Exchange Commission and Fair Debt Collection Practice Act.

The scope of the SOC 1® attestation is determined by the service organization. Accordingly, a well scoped attestation can clearly demonstrate your organization’s quality of service and ensure that sufficient information is provided to your user organization to communicate your stringent controls over physical security, environmental security, authorized access and continuous availability of services.

SOC 1® Compliance Process

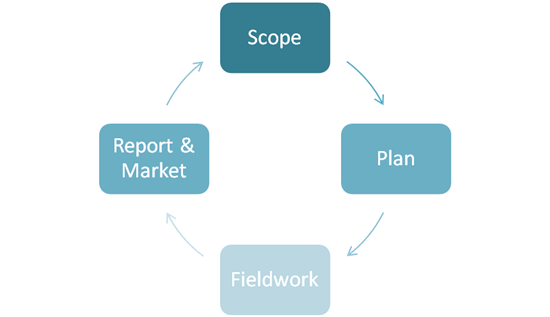

We tailor every attestation engagement to our client’s requirements. However, we have a fundamental four phase process that normally meets our clients’ needs and creates an efficient, unobtrusive attestation engagement that enables you to focus on your business while we focus on your compliance.

Project Timeline: Four Phase Attestation

For More Information Speak to a Service Auditor at Roosa CPA, LLC (877) 410-8516